Why Top Tuning Shops Choose Hyper Power Dynamometers

Tune into the unparalleled precision and power optimization that top tuning shops crave with Hyper Power Dynamometers – setting a new standard in performance enhancement.

When considering financing for a dynamometer purchase, explore options such as dynamometer loans and leasing. These alternatives provide financial flexibility and advantages.

Tailored payment plans from specialised financial institutions can assist in acquiring this essential equipment. Dynamometer loans offer practical financing solutions, while leasing provides flexibility with no upfront payment and deferred payments. Payment plans typically range from 12 to 60 months, aligning with your cash flow.

It is important to investigate these options to maintain cash flow and maximise tax benefits. By utilising these financing options, you can acquire dynamometers without a significant initial cost.

Various financial institutions specialise in dynamometer financing, so it's essential to research these options to meet your business requirements.

Equipment Financing for Dynamometers

Businesses looking to acquire dynamometer equipment can benefit from equipment financing, providing flexible payment terms and tax advantages while avoiding bank restrictions like blanket liens. When considering equipment financing for dynamometers, it's essential to explore the different types available to choose the most suitable option for your business requirements.

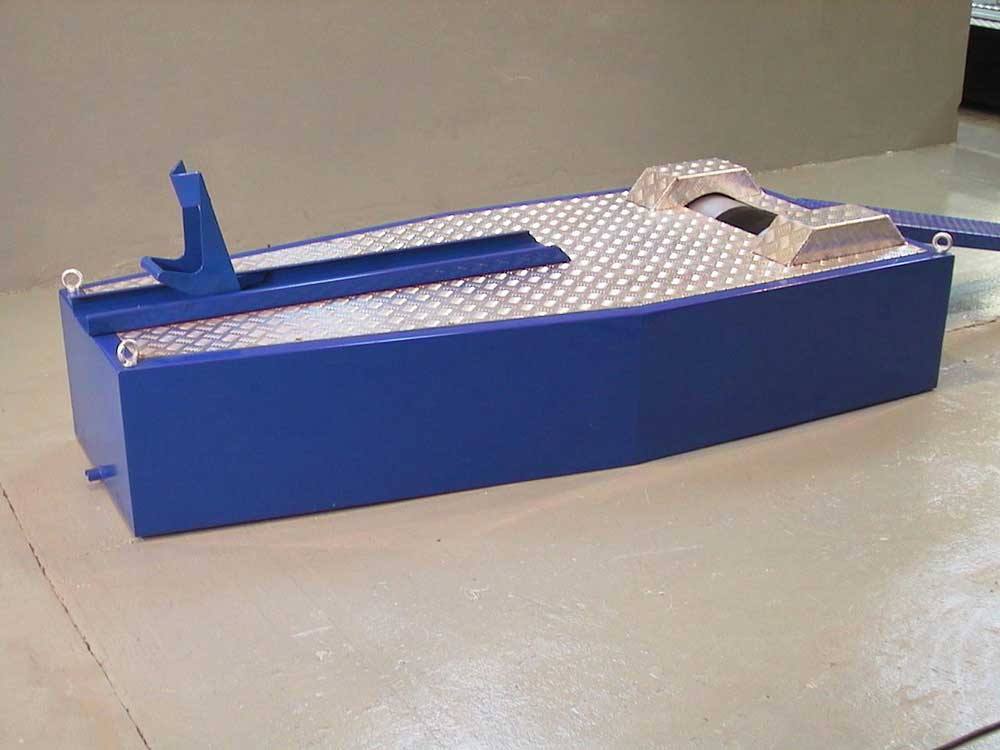

Chassis dynamometers, specifically tailored for vehicles, are perfect for businesses focusing on testing vehicle performance. These dynamometers can cater to a variety of vehicles, including those with all-wheel drive, ensuring comprehensive testing capabilities. Opting for equipment financing enables businesses to obtain chassis dynamometers without a significant upfront payment, thus improving cash flow management. Additionally, the tax benefits linked with this financing option can enhance the financial advantages of investing in quality equipment.

Ultimately, equipment financing for dynamometers offers a practical and efficient way for businesses to access crucial testing equipment while maximising their financial resources.

Obtaining dynamometer equipment through dynamometer loans is a practical and efficient financing option for businesses looking to invest in high-quality testing gear. These loans allow you to acquire a chassis dyno without a large upfront payment, spreading the cost over a manageable period. It's essential to compare interest rates and terms to secure the best deal that aligns with your financial situation.

Comparison of Dynamometer Loans and Equipment Leasing:

| Financing Option | Advantages | Drawbacks |

|---|---|---|

| Dynamometer Loans | Cost spread over time | Variable interest rates |

| Equipment Leasing | Lower monthly payments | Delayed ownership |

Opting for a dynamometer loan enables your business to access the necessary equipment while preserving cash flow for other operational requirements. It's crucial to explore all financing options when investing in a chassis dyno to find the most suitable one for your business needs.

Leasing Dynamometers for Business Needs

For companies looking to enhance financial flexibility when acquiring dynamometer equipment, leasing provides a strategic solution that meets operational and budgetary requirements. Leasing offers benefits such as no initial payment and the option to defer payments for 90 days, making it a financially viable choice for businesses interested in dynamometers without a substantial upfront expense. Payment flexibility is also a significant advantage of leasing, allowing businesses to customise their payment plans by selecting variable payments to align with seasonal cash flow patterns. Additionally, the leasing approval process is typically faster and more accessible than traditional bank loans, often not necessitating complete financial statements.

Examples and Product Recommendations:

Exploring Payment Plans for Dynamometers

Delving into the wide array of payment options available for dynamometers uncovers tailored solutions to match various financial preferences and operational requirements. When looking to finance your dynamometer, payment flexibility plays a vital role in ensuring a seamless acquisition process. Lease financing presents appealing options like zero-down payment schemes and 90-day deferred choices, easing the burden of initial expenses. Additionally, the flexibility to select payment terms spanning from 12 to 60 months provides the necessary adaptability to align with your cash flow and budgetary limitations. One key advantage of leasing is the tax benefits it brings, with lease payments being fully tax deductible to the IRS, potentially saving costs for your business. Opting for a lease also helps sidestep bank constraints such as blanket liens and covenants, guaranteeing a more streamlined and hassle-free financing journey.

Recommendation: Consider exploring lease financing options like those offered by XYZ Leasing Company, which provide zero-down payment plans and flexible payment terms to suit your needs.

Importance of Payment Flexibility

Payment flexibility is crucial when acquiring a dynamometer as it allows you to tailor the payment structure to your financial situation, ensuring a smoother purchasing process. By choosing a payment plan that aligns with your cash flow, you can effectively manage your expenses and avoid financial strain. This flexibility also enables you to invest in other areas of your business while still acquiring the necessary equipment to enhance your operations.

Specific Example: For instance, XYZ Leasing Company offers payment terms ranging from 12 to 60 months, allowing you to choose a timeframe that best fits your budget and operational requirements.

Tax Benefits of Leasing

Lease financing offers significant tax advantages, with lease payments being 100% tax deductible to the IRS. This tax benefit can result in cost savings for your business, providing a valuable incentive to opt for leasing over other financing options. By taking advantage of these tax benefits, you can maximise your financial resources and reinvest the savings back into your business.

Product Recommendation: Consider leasing a dynamometer from ABC Equipment Leasing to benefit from the tax advantages and cost savings associated with lease financing.

Avoiding Bank Restrictions

Opting for a lease to finance your dynamometer can help you avoid bank restrictions such as blanket liens and covenants. This ensures a more straightforward and hassle-free financing experience, allowing you to focus on acquiring and utilising your equipment without unnecessary constraints. By bypassing these limitations, you can streamline the financing process and expedite the acquisition of your dynamometer.

Specific Example: ABC Leasing Services offers lease agreements without restrictive bank covenants, providing a more flexible and efficient financing solution for your dynamometer purchase.

When considering dynamometer loans, one vital aspect to evaluate is the loan terms offered by different financial institutions.

Grasping the variations in interest rates can also play a significant role in determining the total cost of financing your dynamometer purchase.

Comparing these factors can help you make an informed decision and secure the best loan option for your needs.

Automotive Equipment Leasing with Crest Capital

Specialising in automotive equipment leasing, Crest Capital is a trusted financial institution that offers competitive loan terms for dynamometer purchases. Established in 1989, Crest Capital provides a straightforward application process with options tailored for businesses. Their financing terms are flexible and provide benefits designed to suit your requirements. With a quick approval process, you can stay focused on your operations without interruptions. Crest Capital offers advantageous rates and a range of leasing options, making it a top choice for businesses looking to invest in a dynamometer. Contact Crest Capital today to learn more about their dynamometer financing options and experience their efficient approval process.

| Financing Terms | Loan Approval Process | Competitive Rates |

|---|---|---|

| Flexible options | Quick application | Business-friendly |

| Benefits | Hassle-free process | Diverse options |

| Tailored solutions | Minimal delays | Advantageous rates |

Interest Rates Comparison

When comparing interest rates among financial institutions offering dynamometer loans, businesses can discover a range of options that may lead to cost savings. Crest Capital stands out for its competitive rates in dynamometer financing, particularly focusing on automotive equipment leasing for over three decades. On the other hand, Dynomite Dynamometer provides appealing programmes such as zero-down and 90-day deferred payment options, offering businesses flexibility in their financing choices. Crest Capital's efficient application process and business-oriented leasing solutions make it a convenient option for companies looking to secure financing without unnecessary delays. Similarly, Dynomite Dynamometer's leasing options, which are 100% tax-deductible to the IRS and require no upfront payment, present notable advantages for businesses seeking financial support. Exploring these financing options can help businesses find the most suitable fit for their dynamometer acquisition.

Recommendations and Benefits

Businesses considering dynamometer financing should take note of specific benefits offered by different providers. For instance, Crest Capital's extensive experience in automotive equipment leasing since 1989 indicates a deep understanding of the industry's unique needs, potentially leading to tailored solutions for businesses. On the other hand, Dynomite Dynamometer's zero-down payment and 90-day deferred payment programmes offer immediate financial relief and flexibility to companies that may require a more manageable payment structure. By understanding these specific benefits, businesses can make informed decisions that align with their financial goals and operational requirements.

When evaluating financing options for dynamometers, it's essential to assess whether a loan or lease better fits your business needs.

Additionally, examining interest rates and payment terms is crucial. These factors will have an impact on your budget and cash flow, influencing your decision-making process.

Loan Versus Lease: Key Distinctions

Examining the interest rates associated with various financing options for dynamometers is crucial for assessing the cost-effectiveness of acquiring this equipment. Interest rates significantly impact the total amount paid during the financing period. Lenders consider the borrower's credit score when determining interest rates, with lower scores often resulting in higher rates.

Crest Capital provides competitive rates and specialises in automotive equipment leasing, offering potential financing advantages. Dynomite Dynamometer's zero-deposit and 90-day deferred payment schemes feature flexible interest rates, presenting an alternative financing option to consider.

Understanding these interest rate dynamics is essential for making an informed decision on the most suitable financing choice for buying a dynamometer.

Payment Terms

When exploring financing options for dynamometers, it's crucial to assess the payment terms provided by various lenders or leasing companies. Understanding the payment terms for dynamometer financing is essential for making an informed decision:

In conclusion, when looking for financing for the purchase of a dynamometer, there are various options available such as equipment financing, loans, leasing, and payment plans. It is important to explore these alternatives and compare them to find the best fit for your business needs. By working with financial institutions that offer dynamometer loans, you can invest in this equipment without straining your budget. Be sure to research and choose the option that aligns with your goals and financial situation.

For more information on Dynamometer Products, Custom Solutions, Installation Setup, Training and Certification, Technical Support and Maintenance, Software Updates, Rental Services, Dynamometer Testing Services, and Accessories and Parts, feel free to contact Hyper Dyno. If you have any questions, we are here to help.

Tune into the unparalleled precision and power optimization that top tuning shops crave with Hyper Power Dynamometers – setting a new standard in performance enhancement.

Uncover how precise testing impacts vehicle safety and performance, shaping the future of road safety in surprising ways.

Harness the power of dynamometers across various industries to unlock unparalleled performance – discover their transformative impact!

Peek into how dynamometers have transformed vehicle tuning, promising precision and power enhancements beyond imagination.

Yield to the allure of personalized wealth management services at Hyper Power and discover the transformative journey that awaits.

Harness the power of dynamometers to revolutionize automotive engineering and push the boundaries of innovation in the industry.

Uncover how a dynamometer unlocked performance gains beyond expectations, revolutionizing vehicle capabilities.

Accelerate your business growth with hyper power dynamometers, revolutionizing efficiency and performance optimization in various industries.

Hyper Power, the leading name in dynamometer solutions, offers unparalleled precision and reliability for all your performance testing needs.